Water purification is gaining prominence due to the shrinking water resources across the world and increasing wastewater disposal costs. Owing to the growing water crisis and the importance of treating the water for reuse, the demand for wastewater treatment technologies is on the rise.

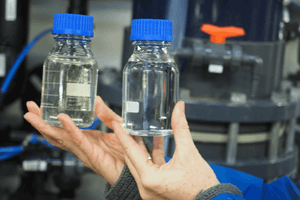

The depletion of fresh water resources has led to the use of more chemicals for water treatment to make it safe to drink, thereby necessitating the use of water purification systems. Water purification system can remove the disease-causing contaminants from the water and improve the quality of water.

The global industrial filtration market is projected to reach USD30.78 billion by 2021, growing at a CAGR of 6% from 2016 to 2021. Water treatment utilizes industrial scale processes that makes water acceptable for end use which maybe be drinking or industrial uses.

It is also utilized to ensure contaminants are removed prior to returning waste water to the environment. The global industrial filtration market growth can be attributed to stringent government emission regulations and the growth of the global power generation and manufacturing industries.

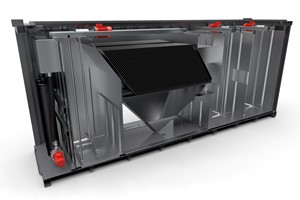

The industrial filtration system was initially used for filtering out impurities from raw material to produce high-quality products. However, given the growing concerns regarding global warming, scarcity of drinking water, and soil degradation, the governments of various countries have imposed regulations to reduce the amount of harmful effluents being released into the environment by industries.

This measure has led to the increasing installation of filtration systems across industries. Liquid filtration systems are estimated to dominate the industrial filtration market, by type. The demand for liquid filtration is fueled by its wide range of application and the growing demand for clean drinking water.

Significant investments are being made across the world to improve drinking water quality. Moreover, the growth of industries that are dependent on water, such as chemicals, oil & gas, power generation, pharmaceuticals, pulp & paper, and food & beverage, is also expected to boost the demand for these filtration systems.

In food & beverage, technology suppliers are developing anaerobic treatment technologies that are more efficient and easier to operate, and which industrial facility operators can use to take advantage of biogas production to reduce their energy costs.

Miners are not just facing intensifying competition for water resources; they must also deal with higher volumes of wastewater. Membranes have begun to offer a solution for treating tailings water, while there is room for improvement in removing cyanides from waste- water following the processing of gold ore.

Asia-Pacific is estimated to lead the industrial filtration market, in terms of growth rate as well as market size, from 2016 to 2021. High growth in the power generation and healthcare & pharmaceutical sectors and new and proactive policy reforms to support the growth of the manufacturing sector in India and China are key factors driving the market in this region.

China is estimated to be the largest market globally, and is set to grow at promising CAGR from 2016 to 2021. India is expected to follow, registering the second-highest growth rate during the same period. Countries such as the U.K., the U.S., Germany, and France are investing in cleaner and renewable power generation methods.

This has reduced the demand for filtration systems in the power generation industry. Furthermore, slow industrial growth and the economic recession are also expected to affect the demand for industrial filtration and restrict market growth.

For instance, the demand for filtration systems in the oil & gas industry witnessed a drastic fall due to the slump in oil prices. Leading players in the industrial filtration market include Mann + Hummel GmbH (Germany), Alfa Laval (Sweden), Donaldson Company, Inc. (U.S.), Parker Hannifin Corporation (U.S.), and Clarcor Inc. (U.S.). New product/service/technology launch is the strategy most widely adopted by players in the industrial filtration market.